Aries and Sagittarius are said to be impulsive spenders. Taurus, Cancers and Capricorns, they say, tend to spend carefully. Geminis, Libras and Leos love spending money without a care in the world while Virgos invest their hard-earned money wisely. Scorpios are good at making money and managing others’ as well. Aquarius are big-hearted and would give their money readily to charity, while Pisceans are dreamers who don’t care about money.

But really, should our signs be the determining factor when it comes to spending money and preparing financially?

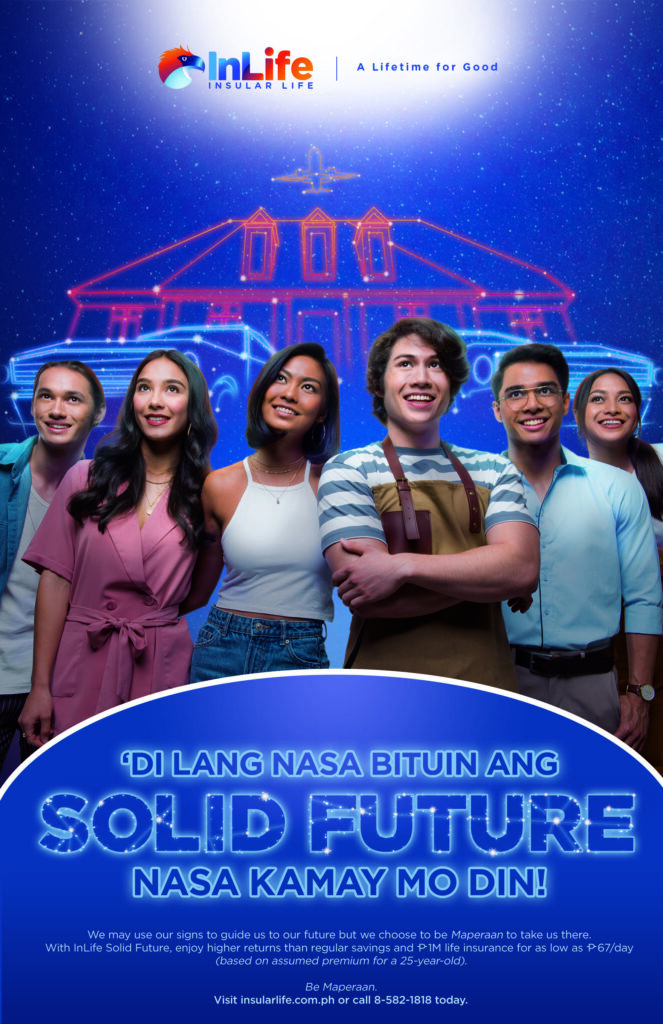

In life, success is usually a product of long years of preparation. The earlier we start, the better because unexpected things that may derail our lives could happen in an instant. Like this pandemic. We have seen how it has ruined the health of many who were infected by it. Even more so, it brought financial crisis to those who were unprepared to lose their source of income because many businesses closed shop. Financial preparedness is evidently needed. However, wrong notions on getting a life insurance plan as provision for this need can block one’s path to financial freedom. InLife’s Solid Future solves this predicament.

Solid Future is an affordable peso-denominated life insurance plan with investment component.

“Young people, who have just gained employment, or got married, or had their first child naturally want to accomplish a lot, but at the same time, prepare for the future by setting aside a portion of their income for savings or investment. Solid Future allows you to do this. For as low as P67 a day or P24,000 a year, you get to build funds earlier and faster towards a solid and protected future,” said InLife Sr. Vice President and Chief Marketing Officer Gae L. Martinez. Solid Future’s low initial charges give the fund potential to grow much faster than other life insurance products in the market. This makes it ideal for Filipinos who want to start saving for long-term goals such as own business venture, , purchase of property, education funds, or retirement.

InLife’s Automated Underwriting System also gives insurance application decisions in as fast as 30 minutes, while regular payments may be made via Automatic Debit Arrangement with banks, making it easier for customers to avail of Solid Future. InLife has also recently partnered with Electronic Commerce Payments or ECPay with over 8,000 payment centers nationwide including convenience stores, pawnshops, remittance and bayad centers, and rural banks, making it easier to pay premiums during times when movement is limited.

Beating the stars on your way to financial freedom is a must. Let InLife’s Solid Future accompany you in that journey.

To know more about InLife’s Solid Future, visit https://www.insularlife.com.ph/solid-future.