In Filipino culture, being present is everything. Whether it’s for birthdays, emergencies, or moments of grief—showing up is how we show love. But what if you couldn’t be there when it matters most?

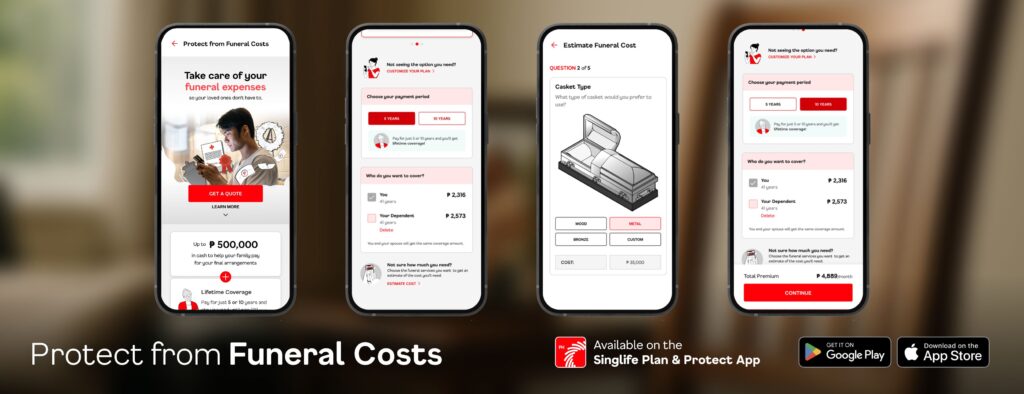

With Protect from Funeral Costs, the latest offering in the Singlife Plan & Protect App, Singlife Philippines makes it possible to do one last act of love—to show up for those that matter most, even when you no longer can.

This whole life insurance product offers a lump sum benefit of up to ₱500,000, which can help families cover funeral arrangements or other end-of-life expenses, giving peace of mind to both policyholders and their loved ones. Fully accessible through Singlife’s all-digital mobile platform, this solution empowers every Filipino to prepare responsibly, protect those they love, and continue showing up—even in their absence.

Losing someone you love is already one of life’s most difficult moments, and having to rely on ‘abuloy’ or having to pass the hat just to pay for funeral costs makes it even harder,” said Lester Cruz, Chief Executive Officer of Singlife Philippines. “Protect from Funeral Costs allows you to prepare in advance and leave behind a final act of love, one that ensures your family can grieve without financial worry. It’s part of our mission at Singlife: to empower every Filipino toward financial independence—in life, and beyond it.”

Growing Suite of Protection in the Singlife Plan & Protect App

Protect from Funeral Costs joins Singlife’s best-in-class suite of affordable, mobile-first insurance and investment solutions. These include life insurance, medical cost protection, and investment-linked plans—all designed to put financial control directly in the hands of customers. Like booking a flight or managing a savings account, buying funeral protection can now be done anytime, anywhere.

With funeral expenses in the Philippines typically exceeding ₱200,000, Singlife’s latest product provides straightforward, flexible coverage in the face of a very real financial risk.

The Protection You Leave Behind

Protect from Funeral Costs provides a lump sum cash benefit that gives your family the flexibility to honor your final wishes in their own way. Whether it’s for a modest ceremony or a more elaborte farewell, your loved ones can decide how to use the money without being locked into a fixed package from a funeral service provider. The product was designed with key features to give customers a convenient and easy way to plan for their funeral expenses.

Customizable and affordable protection: You can choose coverage from ₱100,000 to ₱500,000. Premiums are pocket-friendly, starting at just ₱447 per month, with payment terms of just 5 or 10 years—and your coverage lasts until age 120.

· Built-in Financial Needs Analysis: Not sure how much coverage you need? This feature helps you estimate how much your family may need based on your preferred funeral type, casket, memorial lot, number of viewing days, and expected guests. Since most people don’t realize how much a funeral can cost, this unique tool empowers you to plan ahead and ensure your family won’t be caught off guard.

· Yearly coverage boost*: Keep your policy active and enjoy additional coverage* each year at no extra cost, helping you stay ahead of inflation and rising funeral expenses.

· Spouse and child coverage: Extend protection to your spouse or life partner under one plan. Starting from the second policy year, you also have the option to enroll your child for coverage at no extra cost—no need to buy a separate policy for them.

· Waiver of premiums due to disability: If you become permanently disabled during your premium payment period, you won’t have to worry about future payments—your premium payments will be waived but your coverage will remain active and in force.

· Cash value and loan access: Over time, your policy builds cash value, which you can borrow from starting in the fourth year—giving you extra financial flexibility when needed.

· Immediate cash assistance: Your beneficiaries will receive 10% of the cash benefit in advance upon submission of the policyholder’s death certificate and beneficiary’s identity verification. This helps cover urgent funeral expenses while the remaining amount is released upon claim approval.

*Coverage boosts come from non-guaranteed dividends, and their performance depends on market conditions.

A Final Act of Protection. A Lifetime of Love.

In a country where insurance penetration remains below 2%, Singlife Philippines is challenging the status quo by offering simple, relevant solutions that meet Filipinos where they are—on their phones, and in real life.

With Protect from Funeral Costs, the company transforms what used to be a taboo topic into a powerful expression of love and foresight. Because even if you can’t be there, your protection still can be.

Protect from Funeral Costs is now available exclusively in the Singlife Plan & Protect App, downloadable on the Singlife Plan & Protect App, App Store and Google Play. Check how much coverage you need using the financial analysis tool and get an instant ₱300 in Singlife Credits—free—to help jumpstart your journey to financial independence.

Because love doesn’t stop—even when life does.

Click here to learn more about Protect from Funeral Costs.