The Bank of the Philippine Islands (BPI) continues to solidify its position as a pioneer in sustainable finance, reaffirming its longstanding commitment to embedding environmental, social, and governance (ESG) principles at the core of its business. Anchored on its unique ESG+E₂ framework—which integrates the creation of economic value into its sustainability efforts—BPI is helping lead the transformation of the Philippine banking industry toward more inclusive and resilient growth.

At the center of this shift is BPI’s Sustainability Agenda—a forward-looking strategy that aligns financial performance with sustainable development goals. Through its proactive and innovative approach, the Bank has achieved several industry firsts, further establishing its role as a thought leader in ESG integration.

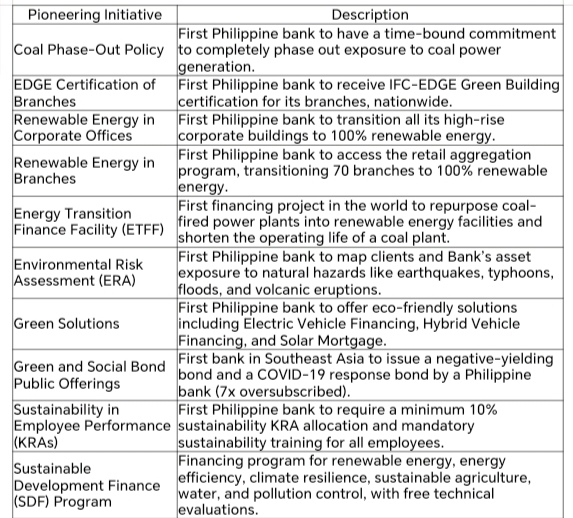

Pioneering Sustainability Initiatives

BPI continues to lead the way in sustainable finance through initiatives that reflect deep integration of ESG in its operations:

BPI is expanding its reach and impact through exclusive, limited-time promotions that promote both sustainability and financial inclusion. These special offers are designed to make eco-conscious choices more accessible for Filipino families and communities.

Here are some offerings that help you Do More for sustainability:

Real 0% Special Installment Plan

(S.I.P.) for Solar Panels

BPI Credit Cards has partnered with Go Solar, Greenergy, JC Solar, and Philergy to offer an exclusive 0% interest installment plan on solar panel purchases. This offer helps more households transition to renewable energy, without the upfront cost. Promo period applies.

Green Solutions Promos

BPI’s commitment to sustainability now comes with added perks for customers ready to go green:

Solar Mortgage Loan – 5678 Promo: Lock in a 5-year fixed rate at just 6.7% and enjoy up to Php 80,000 in waived bank fees.

E-Vehicle “Charge on Us” Promo:

Get ₱5,000 free charging credits when you apply for a BPI Auto Loan for an electric vehicle or plug-in hybrid electric vehicle from June 15 to August 31, 2025, and book on or before September 30, 2025. Credits can be redeemed via the EVRO App and used at any ACMobility EV Charging Station.

These exclusive promos are part of BPI’s broader push to accelerate green adoption while making it more economical for individuals and families to take part.

Sustainability is not a parallel track—it is the foundation of how we do business,” says Eric Luchangco, BPI’s Chief Finance Officer and Chief Sustainability Officer. “We are leveraging our capital, data, technical know-how and partnerships to drive real-world solutions such as energy transition, financial inclusion, and environmental risk reduction. Our goal is to create, protect and further improve long-term value—not only for our shareholders but for the communities and ecosystems we serve.”

BPI is the only Philippine bank that is a member of the Global Compact Network Philippines, the local chapter of the UN Global Compact. It has also been consistently included in the FTSE4Good Index since 2020, reinforcing its standing as a trusted sustainability partner on a global scale.

Through its sustainability-driven agenda, the Bank is not only financing the future—it is actively shaping it.