When I was younger, I learned the importance of saving money. My father would always remind me to put away a certain percentage of my money. At the age of 7, I already have a weekly allowance. Little did he know that I already opened a kiddie account in the bank near my school a few months after the school started because I was envious of my classmates who has the biggest pen ever and they said that they got it when they opened a savings account in that bank. Excited, i brought my money hidden inside a tin can given to me by my mother to the bank the next day. In the space of 20 minutes, i made a deposit, got my biggest pen ever and was a passbook holder. And that was the 80s mind you.

The teller told me the importance of having a savings account. How it’s gonna be my financial cushion in case of an emergency, etc. But my mind was on the list of freebies I could get everytime I reached a tier on my savings. Hence, from that moment on, I l learned to budget my money and to avoid spending more than what my allowance I received weekly.

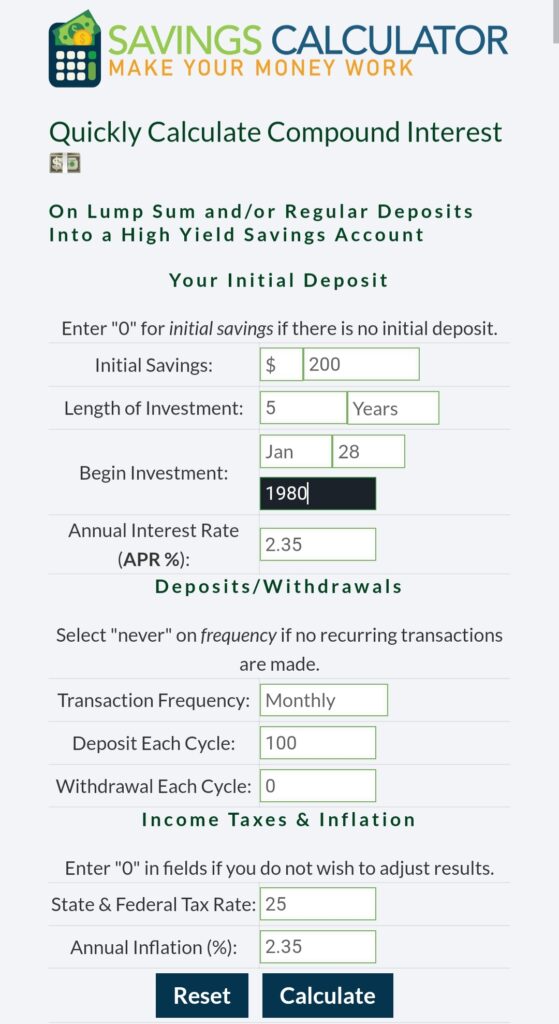

Back then, I realized just now that it was my earliest conception of a saving calculator. A saving calculator is a great tool to help you calculate how much you need to save to reach a certain goal. It can help you plan how much you need to save each month or year to reach your goal by a certain date, and it can also help you calculate how much interest you will earn on your savings. My mind maybe on the freebies but slowly I’m also getting the best interest I coud get. Imagine, if the bank did not close due to the economic crisis that time, I would have more money then but sadly, the bank was not able to give me back my savings.

But that experience did not hinder me from opening another savings account. As i grow older I learned more about the value of savings. I learned that I could save regularly and consistently, spend less than I earn. Additionally, I learned to save for the future and invest wisely. I have my very own financial goals set and I achieved it by saving. For years now, I have a peace of mind knowing that I have the funds available for unexpected expenses or to take advantage of opportunities that may arise. The pandemic did not bother me because I was secured and I have a fallback. Also, thank goodness for the rise of digital banks, I have many options where to put my money and invest it.

Did you know that it helped me a lot when I tried using https://www.savingscalculator.org/. This website is great tool and features many thing such as Planning Calculator and now that I’m getting closer to retirement especially with the news that they lower the retirement age at 56 for government workers, their Retirement Calculator is such a big help. Isn’t this such a useful site? I’d say definitely!

Saving money is important for achieving financial goals, such as paying for college tuition or having enough money for retirement. It also provides financial security in case of an emergency, such as an unexpected job loss or medical issue. Saving money also allows for more opportunities for leisure activities and travel.

A saving calculator is a great tool to help you calculate how much you need to save to reach a certain goal. It can help you plan how much you need to save each month or year to reach your goal by a certain date, and it can also help you determine how much interest you will earn on your savings.

Savings are an important part of financial health. When you save money, you are investing in your future security and helping to ensure that you will be able to support yourself and your family in the long run. It is also key to build an emergency fund, so that unexpected expenses don’t leave you in a bind or without the means to cover them. When setting up a savings plan, it is important to consider how much money to save each month, what type of accounts to open, and how to best take advantage of tax benefits.

First, set a goal for how much money you would like to save each month. This will ensure that you are able to cover the costs of current expenses and save for the future. It is also important to consider how quickly you would like to achieve this goal. For example, if you would like to save $1,000 by the end of the year, you may need to save $100 each month.

Next, you should decide what type of accounts to open. Savings accounts tend to be the most popular choice, since they offer safe and secure storage of your funds while earning a small amount of interest. Other options include money market accounts and certificates of deposit, which offer higher rates of return but also require you to lock your money away for a certain period of time.

Finally, it is important to take advantage of tax benefits offered by savings accounts. Many accounts offer tax benefits, such as deductions for contributions or